prestigespin9.ru Prices

Prices

Bank Of America Paying Off Mortgage

Struggling with home loan payments? We're here to help. Staying in my home Assistance programs may make payments more affordable. Learn more. I will be moving my money out of this bank account, when I feel up to it. mortgage bank asks for the mortgage payment. Of course, it gets denied With. Log in to Bank of America Home Loans customer service center to access your mortgage and/or home equity accounts, make payments, view statements and more. Bank of America offers closing cost grants up to $7, and down payment assistance up to 3% of the home's purchase price or $10, (whichever is less) for. Our Down Payment Grant program offers a grant of up to 3% of the home purchase price, up to $10,, to be used for a down payment in select markets. Grant. Our mortgage provider lets us pay on a biweekly basis, amounting to 26 payments per year. That adds up to 13 months—which means we're making one extra month's. After a loan is transferred, the new servicer takes care of all loan servicing needs including billing, payment processing and customer support. It will result in a new payment amortization schedule, which shows the monthly payments you need to make in order to pay off the mortgage principal and interest. You can use our amortization calculator, available in online banking, to see how additional payments will impact when your loan will be paid off. Struggling with home loan payments? We're here to help. Staying in my home Assistance programs may make payments more affordable. Learn more. I will be moving my money out of this bank account, when I feel up to it. mortgage bank asks for the mortgage payment. Of course, it gets denied With. Log in to Bank of America Home Loans customer service center to access your mortgage and/or home equity accounts, make payments, view statements and more. Bank of America offers closing cost grants up to $7, and down payment assistance up to 3% of the home's purchase price or $10, (whichever is less) for. Our Down Payment Grant program offers a grant of up to 3% of the home purchase price, up to $10,, to be used for a down payment in select markets. Grant. Our mortgage provider lets us pay on a biweekly basis, amounting to 26 payments per year. That adds up to 13 months—which means we're making one extra month's. After a loan is transferred, the new servicer takes care of all loan servicing needs including billing, payment processing and customer support. It will result in a new payment amortization schedule, which shows the monthly payments you need to make in order to pay off the mortgage principal and interest. You can use our amortization calculator, available in online banking, to see how additional payments will impact when your loan will be paid off.

Bank of America's national presence as well as its down payment and closing cost assistance programs make it a convenient starting place for first-time. Bank of America Home Loans is the mortgage unit of Bank of America. It previously existed as an independent company called Countrywide Financial from Grants to offset home-buying costs: These include up to $10, to put toward the down payment or 3% of the purchase price, whichever is lower; up to $7, for. The payoff amount is quoted through the day on which First National Bank of America will receive the funds (certified check, wire, etc.) to pay off the account. This page allows users to request an electronic payoff quote for iSeries and MSP mortgage products. Explore bank accounts, loans, mortgages, investing, credit cards & banking services Redeem for travel, rent credit, or even a down payment on a home. Terms. Recent federal legislation requires automatic termination of mortgage insurance for many borrowers when their loan balance has been amortized down to 78% of the. Our Down Payment Center 1 is a resource to help search for programs you may be eligible for, including our America's Home Grant® 2 and Down Payment Grant. Phone payments can be made using our automated voice response system by calling Agent-assisted loan payments are also available at this number for. mortgage, make payments and get detailed account information right at your fingertips. You can also see details on how you can pay off your mortgage faster. To help with a temporary financial hardship, forbearance may help lower or suspend home loan payments for no more than 90 days. PayPlan allows you to set up automatic mortgage payments to draft from an account at any financial institution, change your payment date, pay more towards. Today's competitive mortgage rates ; Rate · % · % ; APR · % · % ; Points · · ; Monthly payment · $1, · $1, How can I send funds to pay off my mortgage?Expand · Drop off the check at a Wells Fargo branch or mail it to: Wells Fargo Home Mortgage · Deadline (drop-off only). Converting to bi-weekly payments. The first two methods require you to pay extra manually, but this one locks you into a quicker mortgage payoff. Many banks. My CU has a drop-down option when you make a payment. Choices are "Regular Payment" or "Principal Payment". Same options on every loan, whether. Our Down Payment Grant program offers a grant of up to 3% of the home purchase price, up to $10,, to be used for a down payment in select markets. Grant. Bank of America's mortgage unit is unashamed to steal your money. For We wanted to pay off the mortgage on the home my husband's mother lived in. Refinancing can potentially lower your monthly mortgage payment, pay off your mortgage faster or get cash out for that project you've been planning. How do I request a payoff for my account? Contact our customer service department at () or via email at [email protected], Monday through Friday.

The Great Courses Algebra

Syllabus · An Introduction to the Course · Order of Operations · Percents, Decimals, and Fractions · Variables and Algebraic Expressions · Bid now on Invaluable: THE GREAT COURSES SERIES, ALGEBRA II from The Rug Life Auctions on July 30, , PM EST. These 36 accessible lectures make the concepts of first-year algebra-including variables, order of operations, and functions-easy to grasp. For anyone wanting. Title: Algebra 1, Parts 1- 3 [The Great Courses: Science & Mathematics] Cast: Professor Monica Neagoy, Georgetown University [Host]. Algebra I is an entirely new course designed to meet the concerns of both Watch with The Great Courses Signature Collection Start your 7-day free. Syllabus · By This Professor · An Introduction to Algebra II · Solving Linear Equations · Solving Equations Involving Absolute Values · Linear. Algebra I is an entirely new course designed to meet the concerns of both students and their parents. These 36 accessible lectures make the concepts of. Algebra II - The Great Courses - Science and Mathematics - 6 DVDs Plus One Workbook In Three Long Cases by Murray Siegel - ISBN - ISBN The Great Courses: Algebra 1 – Set of 5 · Part 1 DVDs (2) · Part 2 DVDs (2) · Part 3 DVDs (2) · Course Guidebook · Study Workbook. Syllabus · An Introduction to the Course · Order of Operations · Percents, Decimals, and Fractions · Variables and Algebraic Expressions · Bid now on Invaluable: THE GREAT COURSES SERIES, ALGEBRA II from The Rug Life Auctions on July 30, , PM EST. These 36 accessible lectures make the concepts of first-year algebra-including variables, order of operations, and functions-easy to grasp. For anyone wanting. Title: Algebra 1, Parts 1- 3 [The Great Courses: Science & Mathematics] Cast: Professor Monica Neagoy, Georgetown University [Host]. Algebra I is an entirely new course designed to meet the concerns of both Watch with The Great Courses Signature Collection Start your 7-day free. Syllabus · By This Professor · An Introduction to Algebra II · Solving Linear Equations · Solving Equations Involving Absolute Values · Linear. Algebra I is an entirely new course designed to meet the concerns of both students and their parents. These 36 accessible lectures make the concepts of. Algebra II - The Great Courses - Science and Mathematics - 6 DVDs Plus One Workbook In Three Long Cases by Murray Siegel - ISBN - ISBN The Great Courses: Algebra 1 – Set of 5 · Part 1 DVDs (2) · Part 2 DVDs (2) · Part 3 DVDs (2) · Course Guidebook · Study Workbook.

Buy a cheap copy of The Great Courses: Study Workbook for book by The Teaching Company. Free Shipping on all orders over $ Teaching Company. DVD-ROM. Very Good. This 6 DVD set is in Very Good prestigespin9.ru items ship within 24 hours. Packaging is % Recyclable. Shop Electronics' Great Courses Brown Size 6-DVDs DVDs & Blu-ray Discs at a discounted price at Poshmark. Description: The Great Courses Algebra 1. algebra class and was ultimately denied The Great Courses. If so, you can try the Algebra I and/or Algebra II course by James Sellers. Linear algebra may well be the most accessible of all routes into higher mathematics. It requires little more than a foundation in algebra and geometry. Bid now on Invaluable: THE GREAT COURSES SERIES, ALGEBRA II from The Rug Life Auctions on August 20, , PM EST. The Great Courses Science and Mathematics Algebra I Part 1 and Part 2 4 DVDs total Taught by Professor Monica Neagoy Georgetown University the Teaching. 6 videosLast updated on Apr 4, Play all · Shuffle · The Great Courses - Algebra 2 (Part 6). The Secular Ape. The Great Courses Series titled Algebra II. This course has 30 lectures on 6 DVDs, with a Course Guidebook. It also comes with Downloadable PDF of the course. Taking mathematics education to the next level and sharpening problem-solving skills in linear and quadratic equations, Algebra II explains the tools of this. D. If you are shaky on basic math facts, algebra will be harder for you than it needs to be. Spend every day reviewing flashcards of math. The Great Courses: Algebra I James A. Sellers. DVDs. Part 1,2,3. Lot Of 3. Condition is Very Good. Shipped with USPS Media Mail. The Great Courses Algebra 1 Professor James Sellers 6 Disc 36 lectures 30 minutes per lecture & Course Workbook. The Great Courses Algebra I is pages long. Book Reviews (0). 0. | 0 reviews. Did. Taking mathematics education to the next level and sharpening problem-solving skills in linear and quadratic equations, Algebra II explains the tools of this. Algebra 1 – set of 2 (The Great Courses). $ -. Practically new The Great Courses. Find The Great Courses: Science & Mathematics, Algebra 1, Parts 1- 3 book. Edition: DVD. Buy or sell a used ISBN at best price with free. Programs & Courses · College, Trades & University · Power Engineering - Fourth Great Plains College provides educational services in Treaty 4 and 6. Great Courses - Algebra II 6 DVDs in 3 volumes, no workbooks included. Each of the 3 volumes has 10 30 minute lessons, for a total of 15 hours for the. The Great Courses Algebra I is pages long. Book Reviews (0). 0. | 0 reviews. Did.

Is Fannie Mae An Fha Loan

Fannie Mae is actually the nickname for the Federal National Mortgage Association, while Freddie Mac is the nickname for the Federal Home Loan Mortgage. Nearly all banks, lenders, and mortgage brokers offer Fannie Mae home loans. Purchasing a home or refinancing a mortgage, Fannie Mae home loans are an option. Both the Federal Housing Administration (FHA) and Department of Veterans Affairs (VA) offer guaranteed loans to help borrowers with income limitations or those. Fannie Mae operates differently than the FHA; instead of insuring loans, it buys FHA-insured loans from lenders. Flow of Money to Lenders. When banks loan. Fannie Mae is a government agency that buys mortgages from lenders in order for them to reinvest their assets. Its mission is to stimulate the secondary. The main difference between the two is that a Fannie Mae HomeStyle Loan is a conventional mortgage, while an FHA (k) loan is a government-backed option with. Fannie Mae offers expert guidance and insight into the homebuying process, your mortgage options, and what to expect along the way. Therefore all FHA loans are directly backed by the government. FHA approved lenders and their mortgage loans are insured against defaults. Fannie will have various rates depending on lender. FHA will also have additional % mortgage insurance fee that can be paid or financed. Fannie Mae is actually the nickname for the Federal National Mortgage Association, while Freddie Mac is the nickname for the Federal Home Loan Mortgage. Nearly all banks, lenders, and mortgage brokers offer Fannie Mae home loans. Purchasing a home or refinancing a mortgage, Fannie Mae home loans are an option. Both the Federal Housing Administration (FHA) and Department of Veterans Affairs (VA) offer guaranteed loans to help borrowers with income limitations or those. Fannie Mae operates differently than the FHA; instead of insuring loans, it buys FHA-insured loans from lenders. Flow of Money to Lenders. When banks loan. Fannie Mae is a government agency that buys mortgages from lenders in order for them to reinvest their assets. Its mission is to stimulate the secondary. The main difference between the two is that a Fannie Mae HomeStyle Loan is a conventional mortgage, while an FHA (k) loan is a government-backed option with. Fannie Mae offers expert guidance and insight into the homebuying process, your mortgage options, and what to expect along the way. Therefore all FHA loans are directly backed by the government. FHA approved lenders and their mortgage loans are insured against defaults. Fannie will have various rates depending on lender. FHA will also have additional % mortgage insurance fee that can be paid or financed.

This contrasts with FHA loans, where mortgage insurance premiums are a long-term requirement. Additionally, Fannie Mae loans are known for higher loan limits. The Federal Housing Finance Agency (FHFA) publishes annual conforming loan limit values that apply to all conventional loans delivered to Fannie Mae. The Federal Housing Finance Agency (FHFA) publishes annual conforming loan limit values that apply to all conventional loans delivered to Fannie Mae. Fannie Mae may purchase or securitize single-family loans that are insured by FHA under the following Sections of Title II of the National Housing Act. Fannie Mae and Freddie Mac buy mortgages from lenders and either hold these mortgages in their portfolios or package the loans into mortgage-backed securities . Fannie Mae offers expert guidance and insight into the homebuying process, your mortgage options, and what to expect along the way. What is Fannie Mae? Fannie Mae is a nickname for the Federal National Mortgage Association (FNMA), which was chartered by Congress in to be a source of. The housing GSEs are the Federal National Mortgage Association. (Fannie Mae), the Federal Home Loan Mortgage Corporation (Freddie Housing Administration (FHA). This document explains the specific steps for entering certain data for an FHA loan casefile. This document is not intended to provide detailed instructions. It is possible to get a Fannie Mae loan with a 36% back-end debt-to-income ratio. In terms of Fannie Mae income guidelines, borrowers will need to make enough. As of , the maximum conforming Fannie Mae loan limit is $, for a single-family home in most parts of the country. Mortgages with higher limits, called. The Federal National Mortgage Association (FNMA), commonly known as Fannie Mae, is a United States government-sponsored enterprise (GSE) and, since Ginnie Mae is an extension of the Department of Housing and Urban Development (HUD) and specifically deals with non-conventional loans such as FHA loans, VA. FHA loans and conventional loans are both types of mortgages—but an FHA loan is intended for borrowers with lower credit scores and income. Fannie Mae's signature programs include the HomeReady® loan, a low-down-payment loan program, as well as the HomeStyle® Renovation loan, for borrowers seeking. B, FHA Mortgage Insurance Coverage Requirements (05/10/). Print. Share. The servicer must maintain the FHA MI, which was in effect when Fannie Mae. Homeownership is more accessible because they back and secure home mortgage loans. What's with the odd names? If these names same odd to you, you are not the. FHFA is responsible for ensuring that Fannie Mae and Freddie Mac operate in a safe and sound manner. This is done through prudential supervision and regulation. Fannie Mae's main focus is on conventional, conforming loans. These are loans that meet Fannie Mae's underwriting and eligibility standards and conform to loan. This document explains the specific steps for entering certain data for an FHA loan casefile. This document is not intended to provide detailed instructions.

Credit Cards That Earn Flyer Miles

Capital One Venture Rewards Credit Card: Best for simple rewards earning · Chase Sapphire Preferred® Card: Best for beginner travelers · Delta SkyMiles® Gold. Best Airline Card Offers ; Southwest® Rapid Rewards® Performance Business Credit Card. Earn up to , points. Earn 4x points on Southwest Airlines purchases. The best airline credit cards offer perks that can save frequent flyers hundreds of dollars a year. Find the best airline card and start earning miles today. Sign in to see your best offer. Earn MileagePlus award miles through our great selection of United credit card products from Chase. For example, your credit card company might offer you one mile for every $1 you spend using your card. But once you've accumulated enough miles on your credit. For general-purpose travel, the Chase Ultimate Rewards cards (mainly the Sapphire Preferred and Reserve) are often recommended by users, but the. Choose the best airline credit card for your travel needs to earn bonus miles and points toward free flights, and access other travel benefits. These credit cards are offered by specific airlines and allow you to earn miles or points that can be redeemed for flights or other travel expenses specifically. Stack up your miles with these airline credit cards. Find cards with benefits like miles, no foreign transaction fees or checked bags. Capital One Venture Rewards Credit Card: Best for simple rewards earning · Chase Sapphire Preferred® Card: Best for beginner travelers · Delta SkyMiles® Gold. Best Airline Card Offers ; Southwest® Rapid Rewards® Performance Business Credit Card. Earn up to , points. Earn 4x points on Southwest Airlines purchases. The best airline credit cards offer perks that can save frequent flyers hundreds of dollars a year. Find the best airline card and start earning miles today. Sign in to see your best offer. Earn MileagePlus award miles through our great selection of United credit card products from Chase. For example, your credit card company might offer you one mile for every $1 you spend using your card. But once you've accumulated enough miles on your credit. For general-purpose travel, the Chase Ultimate Rewards cards (mainly the Sapphire Preferred and Reserve) are often recommended by users, but the. Choose the best airline credit card for your travel needs to earn bonus miles and points toward free flights, and access other travel benefits. These credit cards are offered by specific airlines and allow you to earn miles or points that can be redeemed for flights or other travel expenses specifically. Stack up your miles with these airline credit cards. Find cards with benefits like miles, no foreign transaction fees or checked bags.

airline: Delta SkyMiles Credit Cards from American Express Elevate your next business trip with a Delta SkyMiles® Business American Express Card and earn. Learn how you can earn Rapid Rewards® points with the SOUTHWEST RAPID REWARDS™ Credit Card when traveling, shopping, and dining. Apply today! You can earn points without flying by signing up for a rewards credit card and using it and shopping with program partners. 1. Focus on Where You Fly. You're. Get the reward you want faster with our credit cards: For every card transaction anywhere in the world, you will earn award miles automatically. Explore our top airline mile credit cards, including the new Delta SkyMiles Gold, Platinum, Reserve and Delta SkyMiles Blue card. Why we love this card: The Capital One Venture X Rewards Credit Card is a solid general travel card for those looking to earn flexible miles on flights. You. Branded air miles cards · British Airways Amex · Virgin Atlantic Reward · Barclaycard Avios – collect points on Oneworld and other partner airlines on the British. You'll earn unlimited x Miles on every purchase that you make with your Discover it® Miles card9. See if this is the best credit card for you. What do you. If you're a frequent traveler, then airline credit cards may be an option worth considering. With these cards, you can earn miles for every dollar you spend. These cards offer some of the highest points bonuses on the market, along with other travel and insurance benefits. · Citi Premier Credit Card - , bonus. Browse our selection of airline rewards credit cards that earn miles or points on everyday purchases. Compare and apply for airline credit cards here. 12 partner offers · The Platinum Card from American Express · Citi / AAdvantage Platinum Select World Elite Mastercard · American Airlines AAdvantage MileUp Card. The JetBlue Plus Card is designed to reward loyal JetBlue customers with a high earning potential, making it easy to rack up points even when not flying. AAdvantage® credit cards ; Special offer: Earn 75, bonus miles. Terms apply. · Citi® / AAdvantage® Platinum Select® World Elite Mastercard® ; Earn 15, bonus. Earn 40, Bonus Miles after you spend $2, in eligible purchases on your new Card in your first 6 months of Card Membership. Enjoy a $0 introductory Annual. Capital One Venture Rewards Credit Card · Enjoy $ to use on Capital One Travel in your first cardholder year, plus earn 75, bonus miles once you spend. An air miles credit card is a type of credit card that rewards you with airline miles or points for every pound you spend using the card. Created with Sketch. 5x points on flights booked directly with airlines, points cap applies. · Created with Sketch. Enroll and earn up to $20/month back at. Earn 50, bonus miles after you spend $3, on purchases in the first 3 months your account is open. You can use your travel rewards credit card to book any airline, anytime, anywhere with no seat restrictions or blackout dates. You can also redeem your.

Who Much Mortgage Can I Afford

How much home can you afford? Use our handy calculator for a rough idea of your home price comfort-zone. How does your income and debt-load impact your numbers? As noted in our 28/36 DTI rule section above, multiplying your gross monthly income by is a good rule of thumb for a max target mortgage payment, including. Use our mortgage affordability calculator to see how your interest rate, down payment and debt ratios affect your housing budget. What percentage of my income should go toward a mortgage? The 28/36 rule is an easy mortgage affordability rule of thumb. According to the rule, you should. Our home affordability calculator could help you estimate how much you can afford to pay for a home as well as your estimated monthly mortgage payment and. What mortgage can I afford? The most you can borrow is usually capped at four-and-a-half times your annual income. It's tempting to get a mortgage for as much. How much home can you afford? Use the RBC Royal Bank mortgage affordability calculator to see how much you can spend and determine your monthly payments. This home affordability calculator looks at your entire financial situation to help you determine how much you can realistically spend on the home of your. Our affordability calculator estimates how much house you can afford by examining factors that impact affordability like income and monthly debts. How much home can you afford? Use our handy calculator for a rough idea of your home price comfort-zone. How does your income and debt-load impact your numbers? As noted in our 28/36 DTI rule section above, multiplying your gross monthly income by is a good rule of thumb for a max target mortgage payment, including. Use our mortgage affordability calculator to see how your interest rate, down payment and debt ratios affect your housing budget. What percentage of my income should go toward a mortgage? The 28/36 rule is an easy mortgage affordability rule of thumb. According to the rule, you should. Our home affordability calculator could help you estimate how much you can afford to pay for a home as well as your estimated monthly mortgage payment and. What mortgage can I afford? The most you can borrow is usually capped at four-and-a-half times your annual income. It's tempting to get a mortgage for as much. How much home can you afford? Use the RBC Royal Bank mortgage affordability calculator to see how much you can spend and determine your monthly payments. This home affordability calculator looks at your entire financial situation to help you determine how much you can realistically spend on the home of your. Our affordability calculator estimates how much house you can afford by examining factors that impact affordability like income and monthly debts.

Loans and Mortgages. How Much Mortgage Can I Afford? Keep in mind that just because you qualify for that amount, it does not mean you can afford to be. When using our mortgage affordability calculator, it helps to be accurate when estimating your monthly living expenses and additional spending. Use this mortgage calculator to estimate how much house you can afford. See your total mortgage payment including taxes, insurance, and PMI. Feel confident about buying a house that you can afford. This calculator will show you how much home you can afford and at different down payment amounts. How much mortgage can you afford? Check out our simple mortgage affordability calculator to find out and get closer to your new home. How much house can I afford based on my salary? Lenders will look at your salary when determining how much house you can qualify for, but you'll need to look. To determine how much you can afford using this rule, multiply your monthly gross income by 28%. For example, if you make $10, every month, multiply $10, Use this tool to calculate the maximum monthly mortgage payment you'd qualify for and how much home you could afford. Here are two common ways to increase how much home you can afford. Reduce your monthly debt. Paying off credit cards or other loans will improve your debt-to-. Use our affordability calculator to estimate a comfortable mortgage amount based on your current budget. Enter details about your income, down payment and. Enter your monthly information: Gross Income $, Property Taxes $, Condominium Fees $, Heating Costs $, Borrowing Payments (eg credit cards, loans) $. How Much Can You Afford? ; LOAN & BORROWER INFO. Calculate affordability by · Annual gross income · Must be between $0 and $,, · Annual gross income ; TAXES. Use this home affordability calculator to get an estimate of the home price you can afford based upon your income, debt profile and down payment. CNN Money advises that in order to arrive at a home price that is affordable, your total debt payments should not be more than 36% of your gross income. To determine how much you can afford for your monthly mortgage payment, just multiply your annual salary by and divide the total by This will give you. Find out how much house you can afford with our home affordability calculator. See how much your monthly payment could be and find homes that fit your. You may be able to afford a home worth $,, with a monthly payment of $2, The amount of a mortgage you can afford based on your salary often comes down to a rule of thumb. For example, some experts say you should spend no more than 2x. Mortgage Affordability Calculator Explore how much house you can afford by entering your annual income or a fixed monthly payment. To receive the most. To get a rough estimate of what you can afford, most lenders suggest you spend no more than 28% of your monthly income — before taxes are taken out — on your.

When Is It Time To Change Careers

If you are ready to make a move, the following are all signs that it's a good time to switch positions. It's never too late to change careers! Whether you're 30, 40, 50 or 60, nobody can tell you that it's too late for a career change. No matter how long. Five Signs It's Time for a Career Change · 1 - You Don't Feel Like You Are Making an Impact at Work · 2 - Your Job is Affecting Your Personal. Without any apparent cause, a general sense of unhappiness at work can be a strong sign that a career shift is needed. It's time to do some self-analysis to. Research the Training You'll Need and Compare Training Options. You may be able to self-study in your spare time at home and pick up necessary skills using. So, no matter whether you hate your job or just want to try something new, now is the perfect time to make a career change. But before you decide on a new. A major career change goes well beyond feeling burnt-out. Experts highlight the real red flags to look for. It might be time for a change if you're feeling unfulfilled, stuck, or unsure about your career path. Here are seven signs that it's time to consider a career. You feel like the job wastes your time and talents, and doesn't make use of your greatest skills. Worse, you're feeling complacent and not actively seeking out. If you are ready to make a move, the following are all signs that it's a good time to switch positions. It's never too late to change careers! Whether you're 30, 40, 50 or 60, nobody can tell you that it's too late for a career change. No matter how long. Five Signs It's Time for a Career Change · 1 - You Don't Feel Like You Are Making an Impact at Work · 2 - Your Job is Affecting Your Personal. Without any apparent cause, a general sense of unhappiness at work can be a strong sign that a career shift is needed. It's time to do some self-analysis to. Research the Training You'll Need and Compare Training Options. You may be able to self-study in your spare time at home and pick up necessary skills using. So, no matter whether you hate your job or just want to try something new, now is the perfect time to make a career change. But before you decide on a new. A major career change goes well beyond feeling burnt-out. Experts highlight the real red flags to look for. It might be time for a change if you're feeling unfulfilled, stuck, or unsure about your career path. Here are seven signs that it's time to consider a career. You feel like the job wastes your time and talents, and doesn't make use of your greatest skills. Worse, you're feeling complacent and not actively seeking out.

#1 Explore making a pivot · #2 If you believe you want a completely new career, narrow down three directions that you'd like to explore and ". Here are 6 surefire signs of an unhappy career choice. You can barely think of positive things to say about your work. If a change in company nor industry will help, then it may be time to switch careers. Changing careers can open more possibilities but will take a little more. Can you pick up the new skills required easily enough? Are you financially in a place where you could absorb a salary cut? Do you have the spare time, work. Apathy has set in. Needing a career change can often feel violently uncomfortable, painful, and deeply emotional. But it can also feel like pure, unadulterated. Changing jobs can be a very exciting time in your career path! It offers new challenges and an opportunity to develop and build your skills. change careers five to seven times during their working life according to career change statistics You know it's time to change your career when it. The good news is that there is still plenty of time to do so. Here are 8 signs, in no particular order, it's absolutely time to change your career. What might've sounded like a challenging and exciting career fresh out of college can easily lose its luster over time. This often occurs when you've been. When did you know it was time to change careers? Canada. And how did you go about it? I'm nearly My career has been fine so far. But I'm no. What Percentage of People Make a Career Change? · years · years. GOBankingRates spoke with career experts to identify what these signs are and outline the steps you should take if you decide to try something new. 1. It's you that wants to make a change, but it's also you that's your biggest obstacle · 2. You can't figure it out by figuring it out · 3. You won't find a job. 1. Why do you want to switch careers? · 2. Can you afford it? · 3. Will making a career transition diminish a passion? · 4. Are you willing to invest in yourself? Wondering whether it's time for a new experiment? Look to these three indicators to figure out if a change is in order. At what point did you know it was time to change careers? I've been in sales ops and order management for the past 10 years and have never. What are the signs you need to change careers? · You're experiencing signs of workplace burnout · You're starting to dream of other career paths · You no longer. When Is It Too Late to Change Careers? · 1. A Desire to Find More Meaningful Work · 2. Access to Better Pay · 3. Too Much Stress or Career Burnout · 4. No Longer. In this article, we analyze what's pushing more workers towards a new career and share tips to help you decide if the time is right for you. So, no matter whether you hate your job or just want to try something new, now is the perfect time to make a career change. But before you decide on a new.

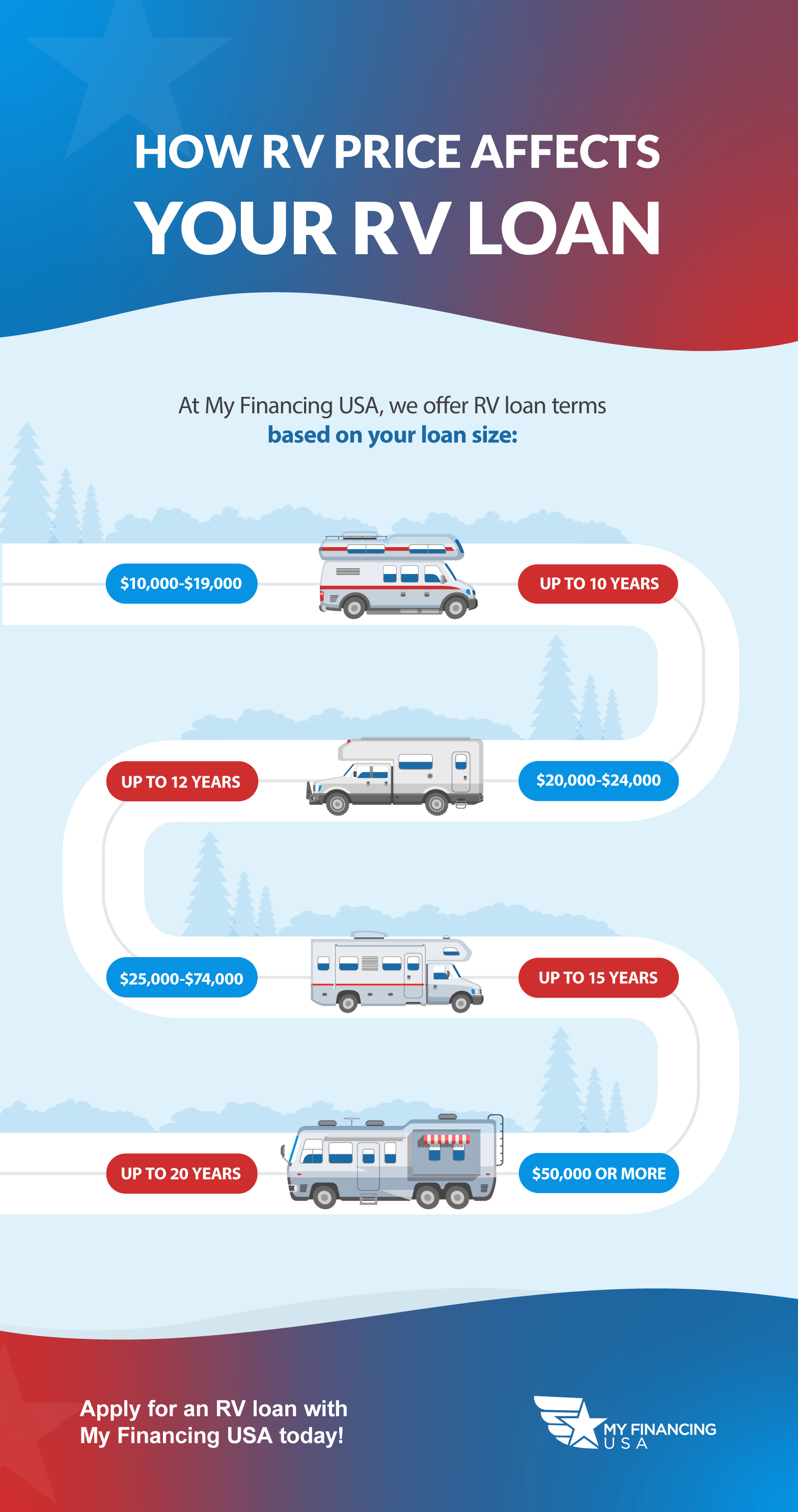

Average Interest Rate For Rv Financing

% is based on average credit score. Step 5. Loan Term. 24 mo, 36 mo, 48 mo, 60 mo. An unsecured RV loan will have an APR ranging from 6% to 36%. See the table below for average unsecured interest rates based on your credit bracket. If you. If so, how much? Step 4. Interest Rate. What finance/RV loan interest rate do you qualify for? % is based on average credit score. Step 5. Loan Term. 24 mo. interest rate might look like. If not, take some time to research average RV loan interest rates and gauge the range of rates you could get based on your. loan terms than the average month car loan. Longer terms are riskier for lenders, which may be reflected in a higher interest rate. Because it's a large. An $88, loan for the purchase of a recreational use RV for 20 years with a fixed rate of % would have an estimated APR of % and payments of. Save with a competitive interest rate. Go with a fixed rate and know your rate will never rise; Pick a variable rate and pay less interest if rates drop*. Take. While the average RV loan is 10 years, other terms are available and may vary depending on many factors, such as: Is the RV brand new, used, or refinanced? How. TD Auto Finance offers competitive renewal rates for our customers who buy RVs, boats, powersport vehicles, cars or trucks. See. % is based on average credit score. Step 5. Loan Term. 24 mo, 36 mo, 48 mo, 60 mo. An unsecured RV loan will have an APR ranging from 6% to 36%. See the table below for average unsecured interest rates based on your credit bracket. If you. If so, how much? Step 4. Interest Rate. What finance/RV loan interest rate do you qualify for? % is based on average credit score. Step 5. Loan Term. 24 mo. interest rate might look like. If not, take some time to research average RV loan interest rates and gauge the range of rates you could get based on your. loan terms than the average month car loan. Longer terms are riskier for lenders, which may be reflected in a higher interest rate. Because it's a large. An $88, loan for the purchase of a recreational use RV for 20 years with a fixed rate of % would have an estimated APR of % and payments of. Save with a competitive interest rate. Go with a fixed rate and know your rate will never rise; Pick a variable rate and pay less interest if rates drop*. Take. While the average RV loan is 10 years, other terms are available and may vary depending on many factors, such as: Is the RV brand new, used, or refinanced? How. TD Auto Finance offers competitive renewal rates for our customers who buy RVs, boats, powersport vehicles, cars or trucks. See.

Financing available in all 50 states. All loans are subject to approval. Rates, terms and conditions are subject to change. A month RV loan with a % APR. The interest rate, the RV term, and the purchase price of the RV will also affect the amount of the monthly payment. If you want to roughly estimate what your. RVs cost too much for the average person to buy in cash upfront. Luckily The interest rate on your RV loan depends on a few factors, namely the. Protect your investment. ; 49 Months. APR* as low as ; New RVs · %, % ; Used RVs · %, %. Competitive Interest Rates. Get a competitive rate and finance your boat/RV through any of our partner dealers. Apply where it's convenient for you. RV payment is $ per month. Definitions. Monthly payment. Monthly payment for your RV financing. Total purchase price (before. At Greater Nevada, recreational loans are offered with competitive interest rates What are typical RV loan terms? plus sign icon. RV loan terms vary by. *Length of term and rate will determine the total interest you will pay over the life of the loan. For example, a month RV loan at % for $20, would. Loan payment example: $ per month for each $1, borrowed at % APR for 60 months. Get Preapproved for an RV Loan: First Name*. For borrowers with excellent credit, the current average RV loan rate ranges from around percent to percent. However, your interest rate will. Auto loans: Ranging on average from % to %; RV loans: Ranging on average from % to %; Difference: RV loan rates are higher by %. Current RV interest rates ; Excellent, , % ; Very good, , % ; Good, , % ; Fair, , %. Compare RV Loans and Rates ; My Financing USA, Best for Low Rates, %% ; NASA FCU, Best Credit Union, %% ; Southeast Financial, Best for Large. Rates are effective 05/17/ and are subject to change without notice. Membership restrictions apply. What Is the Average RV Interest Rate? Interest rates vary but typically range between 4%%. Your credit score plays a large role in determining what. Featured RV loan rate ; APR as low as. % ; Term. 84 months ; Payment per $1, $ NEW/USED RV · 10 Years · % Fixed ; NEW/USED RV · 15 Years · % Fixed ; NEW/USED RV BALLOON 10/20 · 20 Years · % Fixed. How is the interest on an RV loan calculated? The majority of RV loans from RV specialty lenders are simple interest fixed rate loans. What this means is you. Used RV Payment Example: A month used RV loan (model years to ) with an annual percentage rate (APR) of % would have monthly payments of $ Finance a new or used RV, travel trailer, or camper with a rate as low as % APR* for up to 75 months. Additional Features.

Who Has The Highest High Yield Savings Account

Best for earning a high APY: Western Alliance Bank High-Yield Savings Account · Best for account features: LendingClub LevelUp Savings · Best for no minimum. Star High-Yield Savings Account ; Balance Tier $ - $1,, ; Interest Rate % ; Annual Percentage Yield (APY) % ; Available to applicants with a Texas. American Express National Bank savings account · ; Jenius Bank savings account · ; LendingClub savings account · ; Marcus by Goldman Sachs savings. With the Western Alliance Bank High-Yield Savings Premier account, you can enjoy FDIC insurance and no fees3 while earning a much higher return on your money. Grow your wealth quickly with UFB Portfolio Savings. Earn up to % APY, with no maintenance or service fees and no minimum deposit requirement. Our highest-yield savings account is built to give you the competitive advantage you deserve, along with easy mobile and online access. The BrioDirect High-Yield Savings Account earns one of the highest rates on the market at % APY and comes with no monthly fee. The downside is that you'll. A high-yield savings account offers a higher rate of return than a traditional savings account. Learn about the benefits of this type of bank account and. The BrioDirect High-Yield Savings Account offers a competitive rate of % APY and doesn't charge monthly maintenance fees. You might consider another bank if. Best for earning a high APY: Western Alliance Bank High-Yield Savings Account · Best for account features: LendingClub LevelUp Savings · Best for no minimum. Star High-Yield Savings Account ; Balance Tier $ - $1,, ; Interest Rate % ; Annual Percentage Yield (APY) % ; Available to applicants with a Texas. American Express National Bank savings account · ; Jenius Bank savings account · ; LendingClub savings account · ; Marcus by Goldman Sachs savings. With the Western Alliance Bank High-Yield Savings Premier account, you can enjoy FDIC insurance and no fees3 while earning a much higher return on your money. Grow your wealth quickly with UFB Portfolio Savings. Earn up to % APY, with no maintenance or service fees and no minimum deposit requirement. Our highest-yield savings account is built to give you the competitive advantage you deserve, along with easy mobile and online access. The BrioDirect High-Yield Savings Account earns one of the highest rates on the market at % APY and comes with no monthly fee. The downside is that you'll. A high-yield savings account offers a higher rate of return than a traditional savings account. Learn about the benefits of this type of bank account and. The BrioDirect High-Yield Savings Account offers a competitive rate of % APY and doesn't charge monthly maintenance fees. You might consider another bank if.

Put your savings to work with a Gate City Bank high yield savings account, offering our best interest rates with no monthly fees. Here's a closer look! You can open an account anytime, day or night. It's simple, secure, and takes just minutes. Get started with an initial deposit of $ Our High Yield Savings Account is a steady, dependable way to grow your savings without the stress of unexpected fees. Grow your savings with a high-yield savings account from Popular Direct. Put your money to work, open a high-interest savings account today with the best. Best High-Yield Savings Accounts of September Up to % ; SoFi Checking and Savings · SoFi Checking and Savings · at SoFi Bank, N.A., Member FDIC. Certificates of deposit (CDs) can have the highest interest rates among bank accounts. The best CD rates today are above 5% for one-year terms and above 4. Savings accounts and Spend Plus Checking account fees, terms, and conditions. A Spend Plus Checking account is required to receive the highest rate. Must be. I'm looking around, too. Check out Raisin. No fees. Insured. Works with 40+ banks and credit unions to find highest % APY. They also offer CDs. Grow your savings with a high-yield savings account from Popular Direct. Put your money to work, open a high-interest savings account today with the best. Best High-Yield Savings Accounts · Poppy Bank. APY: %. Minimum opening deposit: $1, · Western Alliance Bank. APY: %. Minimum opening deposit: $ · My. Open an American Express Savings High Yield Savings Account (HYSA), you're helping to grow your own money at a rate higher than the national rate. UFB Direct's savings account rivals competitors in rate, with a % APY. With no minimum deposit requirement and zero monthly fees, this account could be a. Our High-Yield Online Savings Account is the smart choice for anyone looking to grow their savings and achieve financial stability. Start your journey to. High-Interest Savings Accounts from Discover Bank, Member FDIC offer high yield interest rates with no monthly balance requirements or monthly fees. The standard insurance amount is $, per depositor, for each deposit insurance ownership category. Fewer fees, greater access. Save on. Best High-Yield Savings Accounts – September ; UFB Portfolio Savings · % ; Synchrony Bank High Yield Savings · % ; Capital One - Performance Savings. Grow your wealth quickly with UFB Portfolio Savings. Earn up to % APY, with no maintenance or service fees and no minimum deposit requirement. With an online high-yield savings account, you can reach your savings goals faster by earning interest at a higher rate than traditional savings accounts. Prepare for your future with a high yield savings account from MAX Credit Union in Central and East AL. Explore our money markets, club accounts and more. Annual Percentage Yield (APY) as of September 10, APY may change at any time before or after account is opened. Maximum balance limits apply. This.

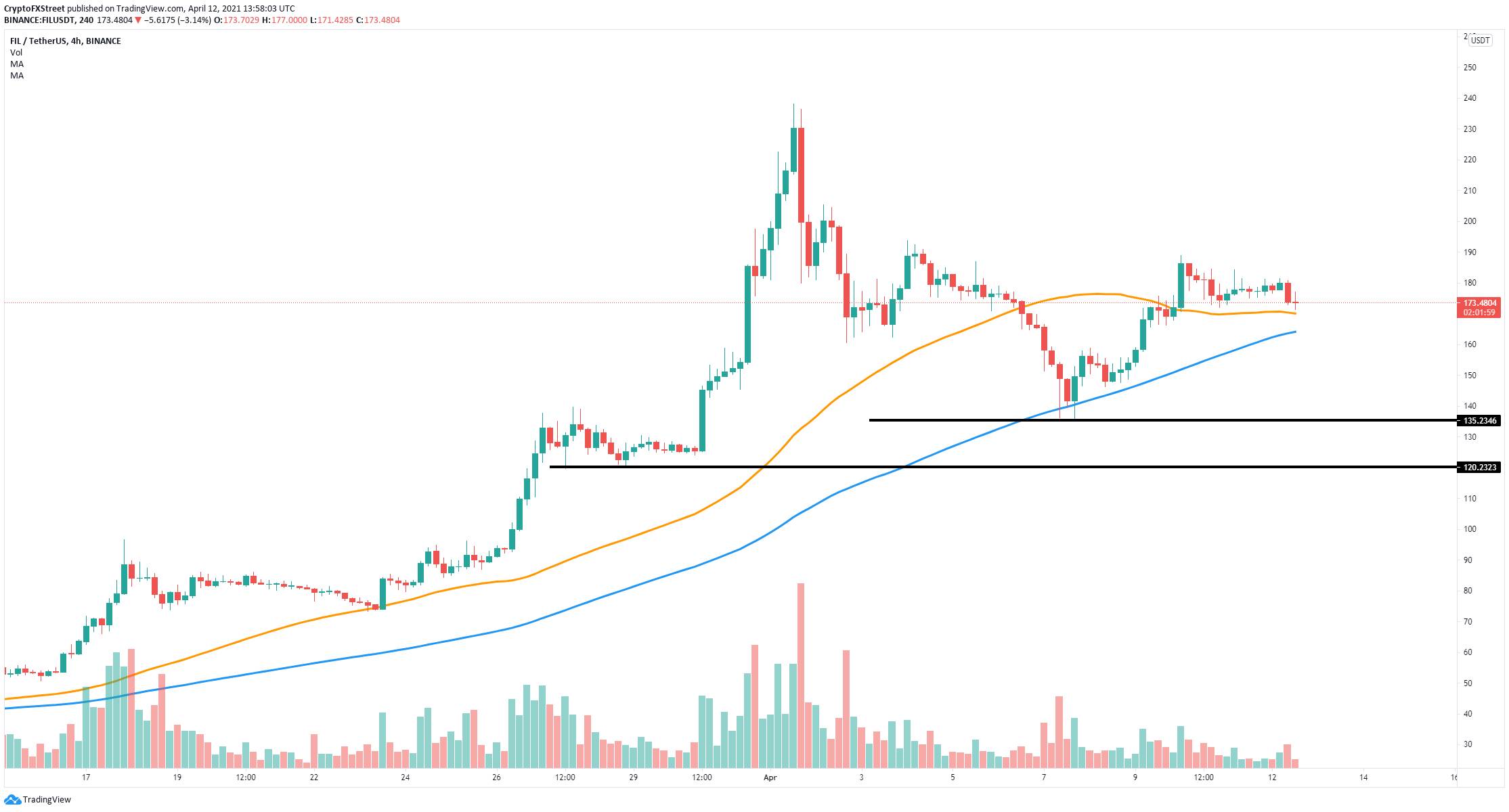

Fedcoin Stock Price

Get the latest price, news, live charts, and market trends about Fedora Gold. The current price of Fedora Gold in United States is $NaN per (FED / USD). market, which might need incentives to provide cheaper and better access to money; increasing efficiency in payments and lowering transaction costs. ; Volume: M · 65 Day Avg: M ; Day Range ; 52 Week Range Analyze your stocks, your way. Leverage the Nasdaq+ Scorecard to analyze stocks based on your investment priorities and our market data. Subscribe Now ->. The current price is $ per TIPS with a hour trading volume of $ Currently, FedoraCoin is valued at % below its all time high of. Buscar resultado para: fedcoin stock price>>BYDcomfedcoin stock price>>BYDcomfedcoin stock price>>BYDcom. Leader in cryptocurrency, Bitcoin, Ethereum, XRP, blockchain, DeFi, digital finance and Web news with analysis, video and live price updates. Fedcoin is a hypothetical digital currency that a central bank, such as the U.S. Federal Reserve, may issue. Fedcoin is also referred to as. Stock analysis for Federal Reserve System (Z:US) including stock price, stock chart, company news, key statistics, fundamentals and company profile. Get the latest price, news, live charts, and market trends about Fedora Gold. The current price of Fedora Gold in United States is $NaN per (FED / USD). market, which might need incentives to provide cheaper and better access to money; increasing efficiency in payments and lowering transaction costs. ; Volume: M · 65 Day Avg: M ; Day Range ; 52 Week Range Analyze your stocks, your way. Leverage the Nasdaq+ Scorecard to analyze stocks based on your investment priorities and our market data. Subscribe Now ->. The current price is $ per TIPS with a hour trading volume of $ Currently, FedoraCoin is valued at % below its all time high of. Buscar resultado para: fedcoin stock price>>BYDcomfedcoin stock price>>BYDcomfedcoin stock price>>BYDcom. Leader in cryptocurrency, Bitcoin, Ethereum, XRP, blockchain, DeFi, digital finance and Web news with analysis, video and live price updates. Fedcoin is a hypothetical digital currency that a central bank, such as the U.S. Federal Reserve, may issue. Fedcoin is also referred to as. Stock analysis for Federal Reserve System (Z:US) including stock price, stock chart, company news, key statistics, fundamentals and company profile.

Only 1 left in stock - order soon. FREE delivery Tuesday, September 3 on Other sellers on AmazonOther sellers on Amazon. Lowest price: Used. $ If you would like to know where to buy FedoraCoin at the current rate, the top cryptocurrency exchange for trading in FedoraCoin stock is currently prestigespin9.ru A U.S. CBDC must provide benefits to U.S. households, businesses, and the overall economy that exceed its costs and risks. It must yield these benefits more. Fedcoin could be a powerful new monetary policy tool which gives the Federal Reserve a direct transmission mechanism by setting interest rates on Fedcoin – a. Fedora Gold's price today is US$, with a hour trading volume of $N/A. FED is +% in the last 24 prestigespin9.ru has a max supply of B FED. More. Fedora Gold's price today is US$, with a hour trading volume of $N/A. FED is +% in the last 24 prestigespin9.ru has a max supply of B FED. More. Cryptocurrencies Prices. Releases. More Series from Coinbase Federal Reserve Bank of St. Louis, One Federal Reserve Bank Plaza, St. Louis. 1 FED Coin is worth $ How to use FED Coin coin in API? To get price and historical data for FED Coin coin. However, after bitcoin plummeted amid stock market volatility in , many experts questioned this argument. The valuation of other cryptocurrencies can be. Investment Specialist at Stocks and Rich Fedcoin is a hypothetical digital currency that a central bank, such as the U.S. Federal Reserve, may. The live FED INU price today is $0 USD with a hour trading volume of $0 USD. We update our FED to USD price in real-time. To be fair, Bitcoin has until to hit the $, price level predicted by the model but I'm not holding my breath. Full Disclosure: I do own Bitcoin and. The price of Bitcoin has rallied back to just above the $43, Currently, Bitcoin's actual price is trading more than 80% lower than what the S2FX model. fedcoin stock price>>BYDcom<<U-fedcoin stock price. About NSE. About Us · Structure & Key Personnel. Foreign Exchange Rates · National Settlement Service · Securities · Wires · Industry This site is a product of the Federal Reserve Banks. Terms of Use. It uses Fedcoin – a conceptual form of Central Bank-issued Digital Currency – to describe the challenges of establishing a stable cryptocurrency, consider. So my kinda Fedcoin wouldn't be a fixed exchange rate regime with Fedcoins The price of bitcoin (market value of mining award); The price of electricity. The official currency of the United States of America. It is managed by the Federal reserve and is tasked with stabilizing prices and maximizing employment. Get Coinbase Global Inc (COIN:NASDAQ) real-time stock quotes, news, price and financial information from CNBC. Exchange Rates and International Data. Foreign Exchange Rates - H/G.5 Federal Open Market Committee announces its tentative meeting schedule for and.